Zero-Targeting Design Systems

🧬 How to train Meta’s algorithm without targeting a damn thing, Media Buyer Index of the Week, and more!

Howdy Readers 🥰

In this newsletter, you’ll find:

🧬 Zero-Targeting Design Systems: How to train Meta’s algorithm without targeting a damn thing

📊 Media Buyer Index: CPC, CAC, ROAS Trends

🏆 Ad of the Day

If you’re new to ScaleUP then a hearty welcome to you, you’ve reached the right place along with 50k+ CEOs, CMOS, and marketers. Let’s get into it, shall we? Oh! Before you forget, if someone forwarded this newsletter to you, don't forget to subscribe to our newsletter so you never miss out!

Together with Particl

Most Brands See Trends Too Late. Don’t Be One of Them

Every launch hinges on timing. Spot a trend early, and you ride the wave. Miss it, and you overspend while competitors capture the demand. That’s the difference between scaling profitably and scrambling to keep up.

With Particl’s Trends Tool, you’ll:

📊 Identify breakout categories before they flood ad channels

🛍 Track aesthetics, styles, and materials shaping consumer spend

🔑 Spot keywords signaling demand shifts in real time

📈 See which companies are quietly pulling ahead

The results speak for themselves: 10,000+ brands like Skims, Gymshark, and Chubbies aren’t guessing. They use Particl to cut entry costs by up to 35% and drive 20–30% higher ROI on trend-driven campaigns. They’re winning with data, and so can you.

Start your 14-day free trial today!

🧬 Zero-Targeting Design Systems: How to train Meta’s algorithm without targeting a damn thing

Most media buyers still think they’re in control. They’re not.

The era of explicit interest targeting is over, and Meta now infers who to show your ad to based almost entirely on creative fingerprinting. If your ad doesn’t resemble the content your ideal customer engages with, it gets stuck in delivery limbo.

Let’s build a real system for the algorithm you’re actually talking to.

💡 The Core Insight: Inference > Interest

Meta no longer needs you to specify audiences. It builds its own based on what your ad looks like, not what it says.

Through image and video embeddings, Meta compresses every ad into a vector and compares it against those that already perform well with known user clusters. This is how it decides where your ad goes.

Which means:

“Creative is the new targeting” is wrong. Creative is the signal that triggers the real targeting.

🧠 Tactic 1: Design for Visual Pattern Matching

Meta favors content that resembles what people already consume. That means your top-of-funnel content must pass the “platform-native” test.

Ask yourself:

Would this blend into a user’s feed without looking like an ad?

Does this visually resemble the UGC, memes, vlogs, or how-tos your audience consumes organically?

Run diagnostic audits on your top ads:

What’s the scene structure? (bathroom, bedroom, street)

What’s the use case visibility? (real-life application shown?)

What’s the actor/talent archetype? (expert, friend, aspirational)

Change these, and you change how Meta routes your delivery.

🔁 Tactic 2: Stop Chasing Manual Control

Still selecting interests or “runners age 30-45” as your audience?

That’s friction. Meta will override it, silently.

Instead, optimize your ad creative to communicate the audience indirectly:

Want runners? Show shoes pounding pavement.

Want skincare buyers? Show realistic texture, not just the bottle.

Want new moms? Show sleep-deprived morning rituals, not a logo.

Meta doesn’t care what your product is, only what your content signals. This is not guesswork. It’s literal inference logic.

🔍 Real Example: Zero Targeting Recovery Ad

Brand: Niche recovery footwear.

Audience: Active 30–50 year olds with joint pain.

What worked:

A top-view unboxing on a worn-out yoga mat

Barefoot walking shots on tile (visual discomfort trigger)

Caption: “Shoes I didn’t know I needed post-pickleball”

No “running” or “fitness” interests were used. Meta connected the visual cues to older active lifestyle patterns, and scaled.

Why It Matters

You’re not buying attention anymore, you’re training an inference machine.

Stop trying to shout at audiences manually. Design for the fingerprint that makes Meta whisper to the right people.

If you’re still optimizing for CTR and “clean layouts,” You’re probably getting outbid by someone optimizing for algorithms instead.

Let Meta do its job. Just feed it the signals it’s looking for.

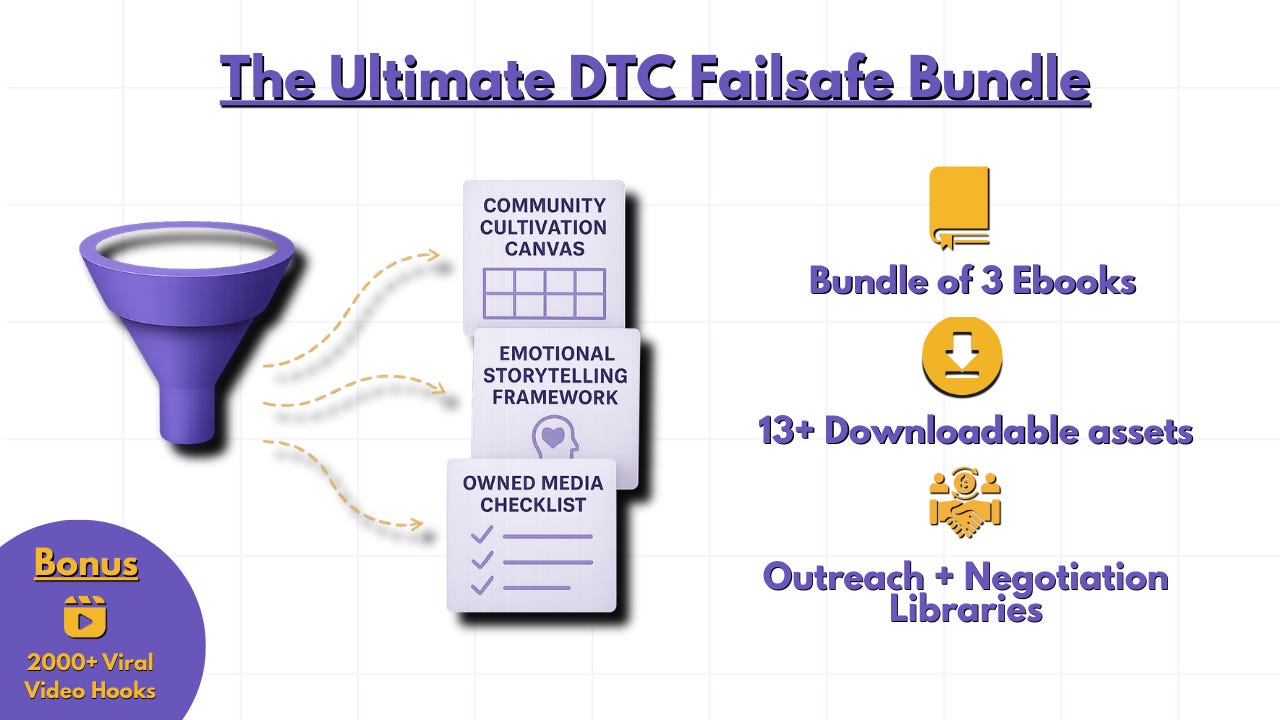

Together with The Hook & Scale System

Your Playbook for Growth That Doesn’t Vanish Overnight.

Every sale you buy with ads comes with a countdown. The second the budget stops, so does growth. That isn’t scaling, it’s sprinting in place.

Networked Growth Engines is how you get off the treadmill and start compounding momentum without paid spend. Built from 3+ months of research into campaigns that turned customers into multiplying assets, it gives you systems for:

Communities that sell for you with setup checklists, engagement calendars, and measurable KPIs.

Referrals that deliver 5× ROI powered by your own viral coefficient forecast calculator.

Partnerships that triple reach with ready-to-send outreach scripts and timelines.

And when you buy today, you’ll also get $900+ in high-value bonuses for just $9:

Rewriting the DTC Rulebook - Counter the 3 shifts killing funnels.

Financial Alchemy - Cashflow and growth timing strategies to scale with confidence.

2,000+ Viral Video Hooks - Updated monthly to keep your creative pipeline unbeatable.

Stop renting growth that disappears. Start owning growth that compounds.

Download your bundle now and build systems that work even when ads stop.

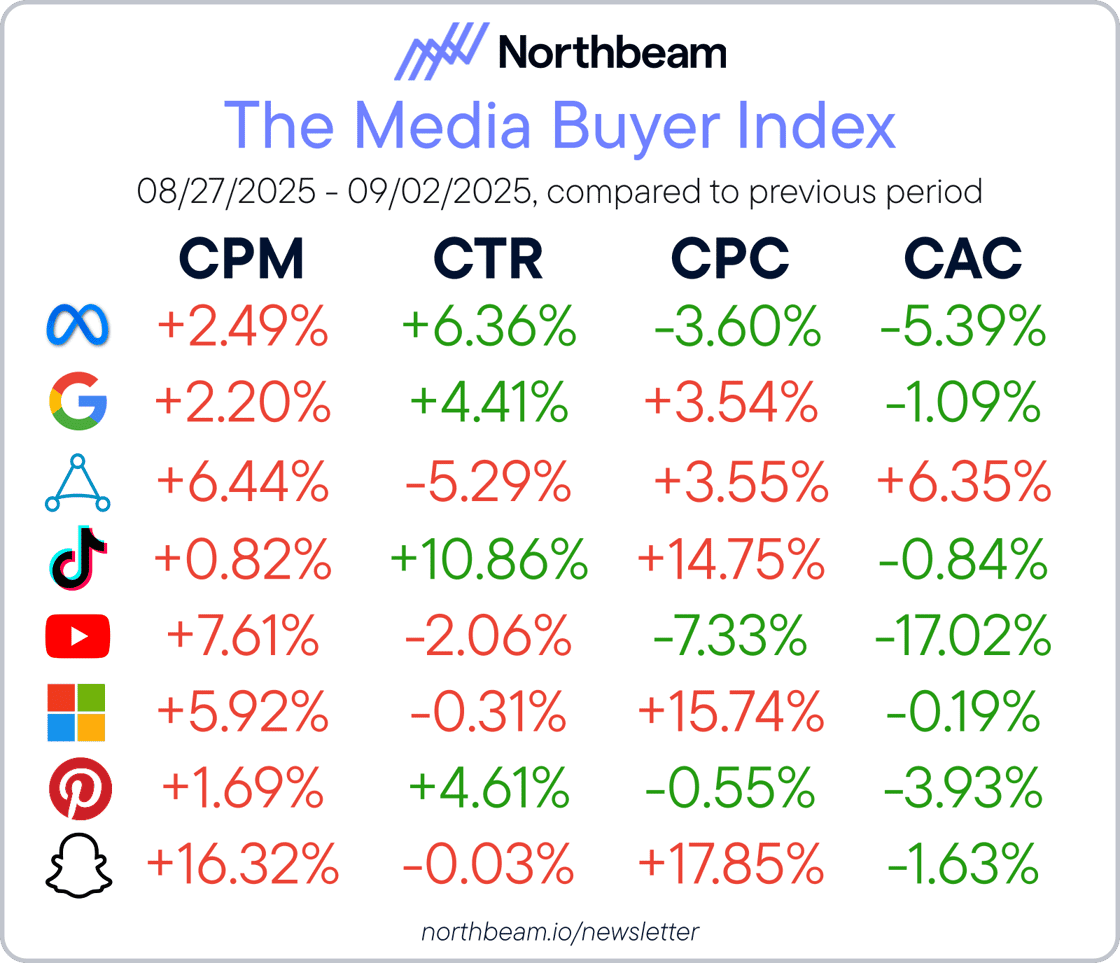

📊 Media Buyer Index: CPC, CAC, ROAS Trends

AI-driven ad performance data from Northbeam (Aug 27 – Sep 2, 2025) shows sharp divergences across platforms in cost and efficiency. While Meta and Google continue to command budget share, smaller platforms reveal hidden opportunities and risks. Here’s the breakdown.

The Breakdown:

1. CPC (Cost per Click) - Snapchat (+17.85%), Microsoft (+15.74%), and TikTok (+14.75%) saw the steepest CPC jumps, signaling rising testing costs. By contrast, YouTube (-7.33%) and Meta (-3.60%) provided cheaper clicks, highlighting widening disparities in platform efficiency for top-of-funnel activity.

2. CAC (Customer Acquisition Cost) - YouTube’s CAC fell sharply (-17.02%), making it the most cost-efficient channel despite high CPMs. Meta (-5.39%) and Pinterest (-3.93%) also improved acquisition efficiency, while LinkedIn (+6.35%) worsened, suggesting platform maturity and creative fit drive acquisition beyond media cost alone.

3. ROAS (Return on Ad Spend) - YouTube (+45.03%) led all platforms, followed by Pinterest (+23.49%) and TikTok (+11.27%). Meta (+8.69%) and Google (+9.93%) showed solid gains, while Microsoft was the only major player with negative ROAS (-5.86%). Strong outperformance on YouTube signals untapped scaling potential versus where budgets sit today.

Meta holds 63.77% of spend (+3.17%), while Google takes 25.77% (-5.42%). But YouTube, despite a +45% ROAS surge, only captures 2.39% (-9.15%) of budget, showing a gap between results and allocations. This imbalance means opportunities exist to reallocate spend toward overperforming but underfunded channels.

🏆 Ad of the Day

What Works and Insights

1. Strong headline focus on outcome – The line “Fall into restful sleep” is simple, direct, and focused on the customer’s desired end benefit rather than the product itself. The move is to always anchor messaging in the result the audience cares about most, and only then introduce the ingredients or science that supports it.

2. Clear differentiation vs. competition – Highlighting “More than melatonin” is a smart way to stand apart from generic sleep aids, setting up a clear comparison that frames the product as superior. Brands can use this strategy by identifying the most common shortcut or solution in their category and showing how their product goes beyond it.

3. Ingredient transparency builds trust – Listing specific amounts like “100 mg GABA & 50 mg L-theanine” gives the ad credibility and speaks directly to health-conscious buyers who demand clarity. Spelling out measurable details instead of vague claims shows confidence and caters to a more informed audience, shortening the decision-making process and strengthening brand authority.

Final Takeaway: This ad shows how pairing emotional benefit-led messaging (“restful sleep”) with rational proof points (ingredient dosages) creates a one-two punch: it connects with both impulse-driven shoppers and analytical buyers. Brands in wellness, skincare, and even tech can borrow this balance, leading with promise, then sealing trust with proof.

Advertise with Us

Wanna put out your message in front of over 50,000 best marketers and decision makers?

We are concerned about everything DTC and its winning strategies. If you liked what you read, why not join the 50k+ marketers from 13k+ DTC brands who have already subscribed? Just follow this.

At ScaleUP, we care about our readers and want to provide the best possible experience. That's why we always look for ways to improve our content and connect with our audience. If you'd like to stay in touch, be sure to follow us EVERYWHERE🥰

Thanks for your support :) We'll be back again with more such content 🥳