TikTok Shop isn’t a Sales Channel

😮 It’s the fastest way to manufacture reusable proof, Media buyer index of the week, and more!

Howdy Readers 🥰

In this newsletter, you’ll find:

😮 TikTok Shop Isn’t a Sales Channel

📊 Media Buyer Index: What Shifted

🏆 Ad of the Day

If you’re new to ScaleUP then a hearty welcome to you, you’ve reached the right place along with 50k+ CEOs, CMOS, and marketers. Let’s get into it, shall we? Oh! Before you forget, if someone forwarded this newsletter to you, don't forget to subscribe to our newsletter so you never miss out!

😮 TikTok Shop Isn’t a Sales Channel

Most brands think in channels. TikTok content lives on TikTok. Paid ads live on Meta. Product pages live on the site. That separation feels organized. It’s also expensive.

Because the highest-performing brands don’t scale by winning on individual platforms. They scale by moving assets between them.

Social commerce content is not an endpoint. It’s a discovery layer.

When creators publish content through TikTok Shop, the value isn’t limited to the sales it generates there. The real value is that it produces raw, authentic proof at scale. People using the product. Reacting to it. Explaining it in their own language.

That content is demand data, social proof, and creative fuel all at once. Letting it live and die inside one platform wastes most of its potential.

The unlock is treating creator content like inventory, not posts.

TikTok Shop already gives you a usable pipeline. Samples go out. Content gets created. Statuses update from shipped to pending to completed.

The moment content is completed is not just a milestone. It’s a transfer point.

That’s when usage rights should be requested automatically, while the creator is still engaged and the exchange feels fresh. Most creators say yes. Often for free. Not because they’re generous, but because the timing is right.

Once rights are secured, the asset stops being TikTok content.

It becomes a multi-channel input.

This is also where operational drag quietly eats margin.

When assets move, but the back office doesn’t, value leaks through slow approvals, messy tracking, and manual reconciliation across teams. Content circulation creates financial complexity that most brands never re-architect for.

This is where shifting to a fractional finance model helps brands keep asset flow efficient without adding internal overhead. Belay’s Guide to Outsourced Accounting breaks down how growing teams maintain clarity as operations scale across channels. You can download your Guide here!

One video can now do multiple jobs.

It becomes a Meta ad that outperforms polished creative because it feels native. It becomes proof on a product page that reduces hesitation. It becomes a retargeting asset that reinforces belief instead of repeating claims.

The same content lowers CAC in paid media, increases conversion on-site, and shortens decision cycles downstream. That’s asset flow.

Channels don’t compound on their own. Assets do. TikTok Shop isn’t powerful because it’s a sales channel. It’s powerful because it’s a content engine.

The advantage doesn’t come from being everywhere. It comes from making sure nothing valuable gets stuck where it was created.

📊 Media Buyer Index: What Shifted

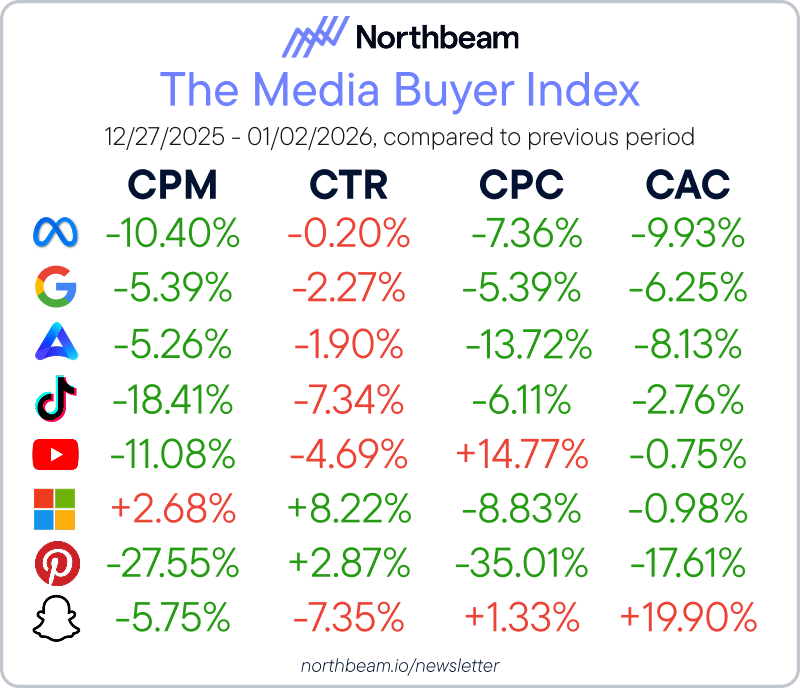

This post-holiday data is less about volatility and more about where efficiency quietly returned. Some platforms are rewarding disciplined spending again, while others are leaking money fast. This is a short window to rebalance before competition resets.

The Breakdown:

1. CPC - CPC dropped across Meta, Google, Amazon, TikTok, and Pinterest, while YouTube and Snapchat rose, signaling cheaper traffic on core performance channels and rising competition on upper funnel heavy platforms.

2. CAC - CAC fell roughly on Meta, Google, Amazon, TikTok, and Pinterest, but spiked nearly on Snapchat, clearly separating profitable scale platforms from those eroding margins for DTC brands.

3. ROAS - ROAS effectively improved ~6%–18% where CAC declined on Meta, Google, Amazon, TikTok, and Pinterest, while Snapchat likely saw ROAS compression as higher CAC outpaced any efficiency gains.

Budget share is clearly shifting as CPM dropped ~10–28% on Meta, TikTok, YouTube, and Pinterest, signaling a spend pullback or efficiency gains. Platforms losing budget are creating short-term arbitrage. Brands that reallocate early usually capture the cleanest margins.

🏆 Ad of the Day

What Works:

1. Audience Fit: This speaks to people who are frustrated and tired, not curious or excited. They have already tried multiple products and just want something that feels gentle and dependable.

2. Emotional Pull: The quote does the heavy lifting, signaling relief and resolution, not transformation or hype, which feels more believable to someone who has been disappointed before.

3. Message Structure - Emotion first, product second. The benefits are supporting details, not the headline, which keeps the ad from feeling pushy or overpromising.

When your buyer is exhausted, lower the volume. Lead with how it feels to finally stop searching, then let simple benefits quietly confirm the choice.

Advertise with Us

Wanna put out your message in front of over 50,000 best marketers and decision makers?

We are concerned about everything DTC and its winning strategies. If you liked what you read, why not join the 50k+ marketers from 13k+ DTC brands who have already subscribed? Just follow this.

At ScaleUP, we care about our readers and want to provide the best possible experience. That's why we always look for ways to improve our content and connect with our audience. If you'd like to stay in touch, be sure to follow us EVERYWHERE🥰

Thanks for your support :) We'll be back again with more such content 🥳