Boxing Day Steals From January

😬The Demand Carryover that Cannibalizes Q1, Media buyer index of the week, and more!

Howdy Readers 🥰

In this newsletter, you’ll find:

😬 Boxing Day Steals From January

📊 Paid media costs fall returns split

🏆 Ad of the Day

If you’re new to ScaleUP then a hearty welcome to you, you’ve reached the right place along with 50k+ CEOs, CMOS, and marketers. Let’s get into it, shall we? Oh! Before you forget, if someone forwarded this newsletter to you, don't forget to subscribe to our newsletter so you never miss out!

😬 Boxing Day Steals From January

Boxing Day numbers often look impressive. Revenue spikes, ROAS improves, and cash flows in. Teams celebrate a strong finish to the year. Then January feels oddly quiet. This isn’t just bad luck or seasonal changes. It’s the Demand Carryover Illusion.

Not all Boxing Day revenue is new. A significant part is taken from future sales. Some buyers who would have shopped in January make their purchases early due to different conditions. The illusion comes from confusing timing with growth.

Why This Happens (and Why Dashboards Miss It)

Boxing Day combines several buying motivations into one moment:

- Holiday emotions haven’t fully faded.

- Rational budgeting hasn’t kicked in yet.

- Price sensitivity is temporarily low.

Buyers who usually need time to think act quickly because urgency and discounts outweigh their caution. Dashboards show a win, but they miss the drop that follows. January demand doesn’t vanish; it arrives drained.

Strategy 1: Separate “Pulled Demand” From “New Demand”

The first solution is to think differently. Stop viewing all Boxing Day buyers as the same. Segment them after purchase based on:

- First-touch timing

- Required discount depth

- Bundle vs. single-SKU behavior

High-discount, single-item buyers are often driven by demand. Treating them as new customers can inflate LTV assumptions and skew Q1 planning. The goal isn’t to cut these sales but to analyze them separately.

Strategy 2: Replace Discounts With Temporal Friction

Instead of pushing harder on price, introduce time-based limits: delayed fulfillment with bonuses, January delivery options, or “Next cycle” access rather than instant rewards.

This keeps revenue intact while preventing future intent from collapsing into the present. You’re changing when value is delivered, not just how cheaply.

Strategy 3: Design Boxing Day as a Bridge, Not a Cliff

Many brands end Boxing Day abruptly. Smarter brands treat it as a transition. Boxing Day offers can lead into January programs. Bundles can unlock future products, not just clear out inventory.

Credits or perks can only be used after the holiday. The aim is to carry demand safely into Q1 instead of wasting it in December.

Strategy 4: Protect Margin Memory, Not Just Margin

Customers don’t remember every discount; they remember the last one. If Boxing Day teaches buyers to expect high value, January pricing can feel like a punishment. Use value-adds, exclusivity, or sequencing instead of deeper cuts.

The Final Insight

Boxing Day isn’t risky due to discounts; it’s risky because it confuses demand timing. Successful brands don’t ask, “How much did we make?” They ask, “How much did we take from ourselves?” Then they create systems to give it back on their terms.

📊 Paid media costs fall returns split

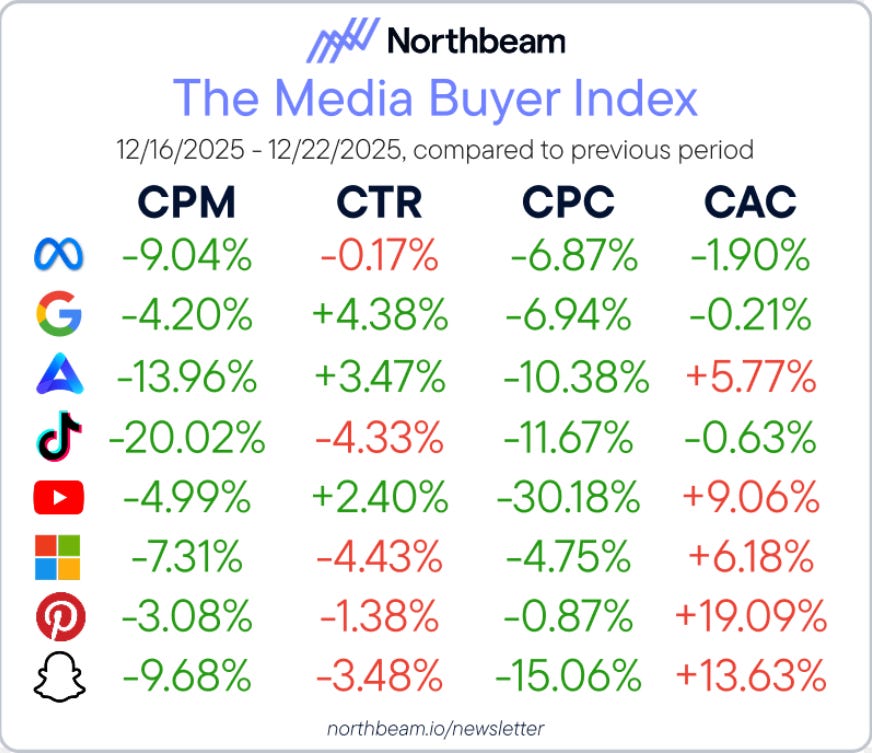

Northbeam’s Media Buyer Index for Dec 16–22 reflects the post-holiday slowdown across paid media. Costs dropped widely, but business outcomes diverged by platform. The data separates cheap traffic from profitable traffic.

The Breakdown:

1. CPCs - CPCs fell across Meta, Google, Amazon, TikTok, YouTube, Microsoft, Pinterest, and Snapchat as competition cooled, creating easier entry points for testing and scaling, but results depended heavily on traffic quality rather than price alone.

2. CACs - CAC improved on Meta, Google, and TikTok while rising on Amazon, YouTube, Pinterest, Microsoft, and Snapchat, showing that lower costs only helped where intent, creative, and conversion paths were already strong.

3. ROAS - ROAS increased on Meta +6.76%, Amazon +2.11%, and YouTube +5.01% but declined on TikTok −7.28%, Google −0.51%, Microsoft −13.39%, Pinterest −13.23%, and Snapchat −11.77%, reinforcing that efficiency gains come from execution, not discounts.

Meta still commands 63.57% budget share with rising ROAS, keeping it the most dependable performance channel. Google holds 26.03% of spend but saw ROAS soften slightly. This is a reminder to follow profitable scale, not just cheaper clicks.

🏆 Ad of the Day

What Works:

1. That flavor combo makes you stop - Chili and chocolate together just mess with your head in a good way. You don’t scroll past because you’re already imagining how that would taste.

2. Two names, less doubt - Seeing Raaka next to Momofuku makes this feel like a safe experiment. Even if you’re unsure about spicy chocolate, you trust the people behind it enough to give it a shot.

3. Limited, but chill about it - They say it’s limited without freaking out about it. That makes it feel special, not desperate, like something you’ll regret missing rather than something being pushed on you.

This ad works because it makes trying something new feel exciting but not risky. It sparks curiosity, builds trust, and lets your imagination finish the sale.

Advertise with Us

Wanna put out your message in front of over 50,000 best marketers and decision makers?

We are concerned about everything DTC and its winning strategies. If you liked what you read, why not join the 50k+ marketers from 13k+ DTC brands who have already subscribed? Just follow this.

At ScaleUP, we care about our readers and want to provide the best possible experience. That's why we always look for ways to improve our content and connect with our audience. If you'd like to stay in touch, be sure to follow us EVERYWHERE🥰

Thanks for your support :) We'll be back again with more such content 🥳