Answer this before hitting send

❓Every campaign trains something. The only question is what, Media buyer index of the week, and more!

Howdy Readers 🥰

In this newsletter, you’ll find:

❓Answer this before hitting send

📉 Costs crept up, returns got uneven

🏆 Ad of the Day

If you’re new to ScaleUP then a hearty welcome to you, you’ve reached the right place along with 50k+ CEOs, CMOS, and marketers. Let’s get into it, shall we? Oh! Before you forget, if someone forwarded this newsletter to you, don't forget to subscribe to our newsletter so you never miss out!

Together with Athyna

Connecting LLMs to production systems means handling rate limits, context windows, prompt versioning, and error states that most teams underestimate.

You need engineers who understand the full integration stack and ship features that hold up under load.

Python and JavaScript expertise

LLM and API integration at scale

Production-tested implementations

This is the kind of talent you get with Athyna Intelligence—vetted LATAM engineers working in U.S.-aligned time zones.

❓Answer this before hitting send

A revenue push goes out. The number hits. The channel looks healthy. What rarely gets discussed in the post-mortem is the behavior that was just reinforced.

Campaigns don’t just generate sales. They shape buying patterns, expectation cycles, and margin tolerance.

That’s where the Internal Rule comes in.

Before any revenue campaign goes live, it must answer one question clearly:

What long-term behavior are we reinforcing?

This isn’t philosophical. It’s operational. Because if the behavior being reinforced is “wait for discount,” the campaign is borrowing from future demand.

Consider the failure mode. A 20 percent incentive spike lifts conversion from 2.4 percent to 4.1 percent. Two weeks later, full-price conversion drops below baseline. This isn’t random. It’s conditioned timing. Customers learned the cadence.

The Internal Rule forces the team to confront that mechanism before hitting send.

Here’s how it works in practice:

If the campaign reinforces “buy at launch,” it protects velocity.

If it reinforces “buy at restock,” it stabilizes inventory flow.

If it reinforces “engage to unlock,” it builds participation equity.

If it reinforces “wait for deal,” it erodes pricing power.

Notice the constraint. Revenue can go up in all four scenarios. Only one compounds.

This rule also exposes internal incentives. When teams are measured on short-term revenue, the temptation is to optimize for immediate lift.

Without a behavioral checkpoint, the easiest lever wins. The Internal Rule slows that reflex just enough to evaluate second-order impact.

There is a tradeoff. Some campaigns that would have hit a monthly target will get killed. That’s uncomfortable, especially when pressure is high.

But the alternative is cumulative behavior drift that compresses margin and destabilizes forecasts.

Why this works is simple. Pricing power is a behavior loop. Each send either strengthens it or weakens it.

When leadership formalizes behavior reinforcement as a gating metric, the quality of campaigns changes.

Email stops being a reaction tool and becomes a strategic instrument.

Revenue still matters. But it stops being the only scoreboard.

And when every campaign is filtered through the lens of long-term behavior, growth becomes more durable because the system is being trained intentionally, not accidentally.

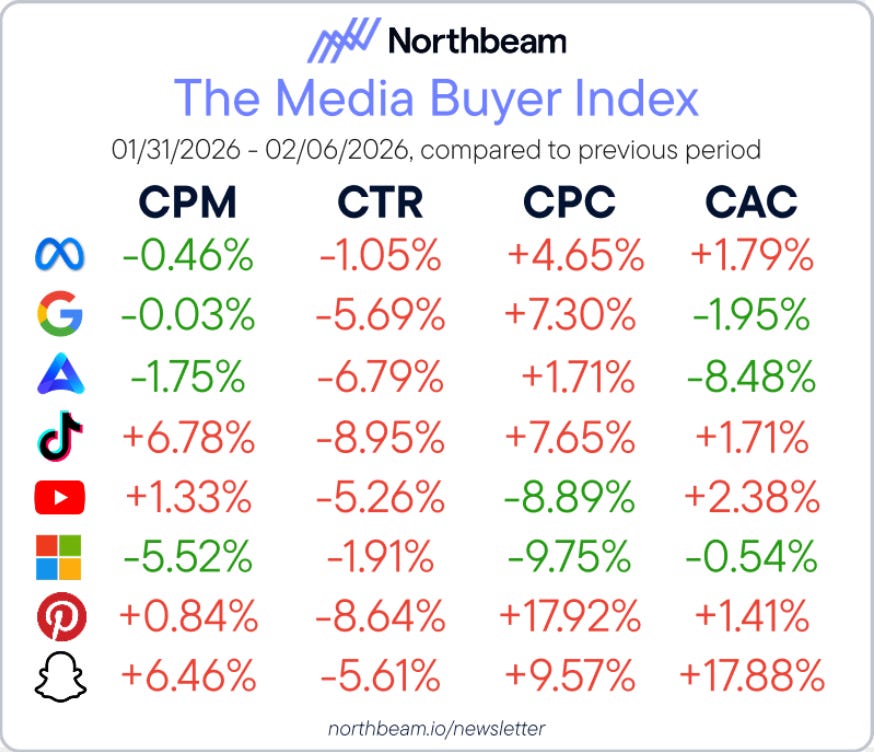

📉 Costs crept up, returns got uneven

This week’s media buyer landscape felt more expensive and less predictable. Traffic costs moved higher in many channels, while conversion efficiency slipped in several growth pockets. Teams that stay disciplined on testing and budget pacing will protect margin.

The Breakdown:

CPC - Costs rose on Meta, Google, Amazon, TikTok, Pinterest, and Snapchat. Costs fell on YouTube and Microsoft. With more platforms seeing higher click costs, buying discipline and faster creative rotation matter more than broad expansion.

CAC - CAC rose on Meta, TikTok, YouTube, Pinterest, and Snapchat. CAC fell on Google, Amazon, and Microsoft. Conversion quality weakened in several growth channels, which means scaling there without fixing funnel friction will compress margins.

ROAS - Microsoft led with +11.02% ROAS, with Snapchat up +2.56% and Meta slightly positive at +0.04%. Google, Amazon, TikTok, YouTube, and Pinterest declined, with Pinterest down -11.04%. Return strength is concentrated, not broad, so scale selectively.

Spend remained heavily concentrated, with the largest channel at 63.34% budget share despite a pullback of -3.07%. The second-largest channel gained to 27.57% share, while several smaller platforms added incremental share. Protect core spend, but test aggressively where ROAS is trending up.

🏆 Ad of the Day

What Works:

This turns a Commodity Into a Keepsake: Oreos are everyday snacks. Personalization upgrades them into something emotional, which instantly justifies buying them for an occasion instead of the grocery aisle.

They Borrow Meaning From the Moment: Valentine’s Day does the emotional heavy lifting. Oreo just plugs itself into an existing ritual, so the product feels thoughtful without needing a new story.

This Is About Shareability, Not Taste: No one’s questioning how Oreos taste. The real value is “look what I made,” which turns the product into a social object.

If your product is already loved, don’t change it. Add a layer of personalization so people can use it to say something they couldn’t say before.

Advertise with Us

Wanna put out your message in front of over 50,000 best marketers and decision makers?

We are concerned about everything DTC and its winning strategies. If you liked what you read, why not join the 50k+ marketers from 13k+ DTC brands who have already subscribed? Just follow this.

At ScaleUP, we care about our readers and want to provide the best possible experience. That's why we always look for ways to improve our content and connect with our audience. If you'd like to stay in touch, be sure to follow us EVERYWHERE🥰

Thanks for your support :) We'll be back again with more such content 🥳